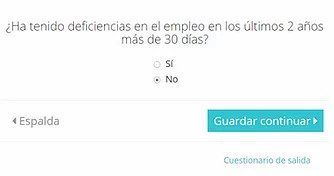

The founders of PerfectLO knew there was a better way to initiate the mortgage process. They used their extensive industry knowledge to construct a detailed, interactive questionnaire that systematically and intelligently asks all the right questions.

No more inaccurate loan applications due to assumptions or inadequate fact-finding. No more unnecessary credit pulls or wasted time and money on loans that will never be closed. No more missed questions that require additional documentation.

The result is a simplified and streamlined process that leads to clean and accurate approvals.

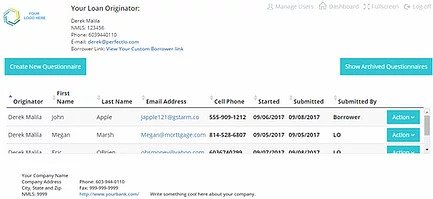

This interactive, easy-to-use software allows Borrowers to complete the in-depth loan questionnaire at their convenience on any mobile device or desktop.

The Originator can also interview the Borrower “Live” while following the systematic fool proof process.

Loan Originators are able to fully understand a Borrower’s mortgage needs and risk, without triggering TRID.

PerfectLO provides a summary of key information to Loan Originators and exports the results into their Loan Origination Software (LOS).